Property and Wealth Protection

One of the primary reasons couples in Ontario choose to create a prenuptial agreement is to clearly define property rights. Under the Ontario Family Law Act, assets acquired during a marriage are subject to equalization if the marriage ends. However, a prenuptial agreement (legally referred to as a marriage contract in Ontario) allows couples to customize these rules.

When it comes to property and wealth protection, the agreement can:

- Differentiate between pre-marital and marital property: You can outline which assets you brought into the marriage and specify that they remain solely yours in case of separation or divorce. This prevents disputes over what counts as “family property.”

- Clarify ownership of real estate, investments, and savings: If one partner owns a home, rental property, or investment portfolio before marriage, the agreement can confirm continued ownership. Couples may also decide how savings and retirement funds will be divided.

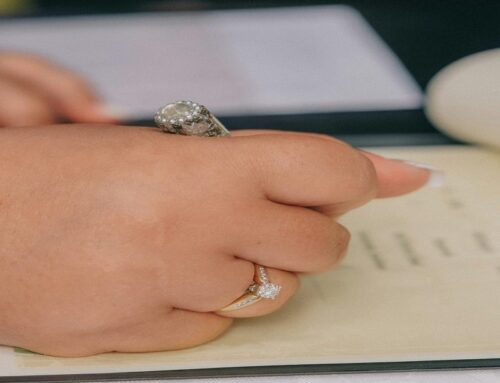

- Protect family heirlooms or high-value personal assets: Items like jewellery, artwork, or other family heirlooms can be excluded from division. This ensures that property with sentimental or generational value remains in the rightful family line.

Managing Debt and Future Financial Risks

Debt is often just as important as assets when preparing a prenuptial agreement in Ontario. While couples usually think about dividing property and wealth, addressing existing and future financial risks can prevent serious conflicts down the road.

A prenuptial agreement can help by:

- Deciding who is responsible for existing debts: Many Ontarians enter marriage with credit card balances, student loans, or even mortgages from before the relationship. A prenuptial agreement can specify that such debts remain the sole responsibility of the person who incurred them, protecting the other partner from unwanted financial obligations.

- Protecting one partner from the other’s risky financial decisions: If one spouse runs a business, invests in high-risk ventures, or frequently uses credit, the agreement can shield the other partner from being dragged into those liabilities in the event of separation.

- Creating strategies for managing shared loans during the marriage: Couples often take on joint mortgages, car loans, or lines of credit together. A well-crafted agreement can outline how these debts will be managed, paid off, and divided if the marriage ends, reducing the potential for disputes.

Lifestyle and Financial Expectations

While property and debt are central to prenuptial agreements, many Ontario couples also use these contracts to outline day-to-day financial expectations.

A prenuptial agreement can:

- Set out how household expenses will be divided: Couples can decide whether bills, groceries, and utilities will be split equally, paid proportionally to income, or handled in another agreed-upon way.

- Address joint bank accounts vs. separate accounts: Some spouses prefer to pool all resources into one account, while others keep their income separate. A prenuptial agreement can clarify whether joint accounts will exist and how they will be used, creating financial clarity for both parties.

- Establish savings goals, retirement contributions, or investment strategies: Couples can align on long-term financial planning, such as building an emergency fund, setting aside money for children’s education, or agreeing on retirement savings contributions.

Including lifestyle and financial expectations in a marriage contract gives couples a structured plan that reflects their unique needs and values. In Ontario, this type of clarity can strengthen trust and reduce potential financial disputes over time.

Business, Career, and Professional Interests

For many Ontarians, careers and business ventures represent years of effort and investment. A prenuptial agreement can protect these interests while also ensuring that a spouse’s contributions are respected.

A marriage contract can address:

- Keeping a family business or professional practice separate: If one partner owns or co-owns a business prior to marriage, the agreement can confirm that the business remains their independent property. This prevents disputes about ownership or future growth if the relationship ends.

- Deciding how income, shares, or partnerships will be handled: A spouse may wish to specify that profits, dividends, or partnership rights remain personal rather than shared assets. Alternatively, couples can agree on how business income will be contributed toward household expenses.

- Protecting intellectual property, patents, or creative work: Professionals, entrepreneurs, and artists in Ontario often create unique assets that grow in value over time. A prenuptial agreement can ensure that these rights — whether patents, trademarks, or creative works — remain with the original creator, safeguarding future royalties or licensing income.

Estate, Inheritance, and Family Planning

A prenuptial agreement in Ontario can also address how inheritances, gifts, and estate matters will be managed.

- Clarifying how inheritances and gifts will be treated: Under Ontario’s Family Law Act, inheritances and gifts received during the marriage are generally excluded from property division — unless they are used toward the matrimonial home. A prenuptial agreement can reinforce or expand on these protections, ensuring clarity about how such assets will be handled.

- Coordinating a prenup with wills, trusts, and estate planning: A marriage contract works best when paired with proper estate planning tools. Couples can align the terms of their prenuptial agreement with their wills, trusts, or beneficiary designations, creating consistency and avoiding future conflicts.

- Providing security for children from previous relationships: For couples entering a second marriage or partnership, a prenuptial agreement can protect assets intended for children from earlier relationships. This ensures that inheritance plans are respected while still supporting the new marriage.

What Cannot Be Included Under Ontario Law

While prenuptial agreements in Ontario allow couples to customize many aspects of their financial relationship, there are important legal limits. Understanding what cannot be included is just as essential as knowing what can.

- Why custody and child support cannot be pre-set in a prenup: Ontario courts will not enforce clauses that attempt to determine child custody or child support in advance. Decisions about parenting arrangements and support must always be based on the best interests of the child at the time of separation, not predetermined by a contract.

- Limits on clauses that would create unfair hardship: Courts in Ontario may set aside or modify a prenuptial agreement if it is found to be grossly unfair or causes undue hardship. For example, a clause that leaves one spouse with nothing while the other retains significant wealth may be challenged.

- Legal requirements: full financial disclosure and independent legal advice: To be enforceable, a marriage contract in Ontario must be signed voluntarily, in writing, and ideally witnessed. Each party should provide complete financial disclosure and obtain independent legal advice (ILA). Without these steps, the agreement risks being invalidated by the court.

Numan Bajwa is the Founding Partner at Bluetown Law – Family Lawyers. He earned his Juris Doctor from the University of Detroit Mercy School of Law (2011–2014) and holds an Honours degree in Criminology from the University of Windsor (2003–2008).